Hotel and restaurant tax: tariffs, calculations, payment and reporting (part 2)

Before reading, we recommend that you read the previous article “Restaurant tax: tariffs and calculation (part 1)” on this topic.

For many years, the island of Bali has been drawing attention with its potential for the hotel business. The demand for various forms of accommodation, from cozy villas to luxurious resorts, is constantly growing. Here, it’s possible to create unique architectural and designer concepts that attract travelers from all over the world. However, for the success of your business, it is important to have a good understanding of the tax aspects related to real estate.

The firm “Legal Indonesia” is an expert in Indonesian law and provides assistance to investors at all stages of conducting business. The team consists of experienced specialists, including lawyers, accountants, and other professionals, ready to provide comprehensive support in taxation and accounting services.

In this article, we offer an overview of the hotel tax, its key provisions, and calculation methods.

Hotel tax is a tax levied for providing hotel services. A hotel or inn is an establishment that offers accommodation and leisure services, as well as related services for a fee. Hotel include:

Guest house

Motel, hostel, hotel

Similar accommodation and short-term stay facilities

A house with more than 10 rentable rooms in one location or several, managed by one taxpayer.

Objects, subjects and taxpayers of the hotel tax

The object of the hotel tax is any provision of services by a hotel, including:

Tourist houses, motels, guest houses, and rooms for rent in quantities exceeding 10 at one more location, managed by one taxpayer.

Facilities and means supporting accommodation, such as telephone, fax, internet, laundry services, transportation, and so on.

Room rental services for events or meetings in the hotel

The subject of the hotel tax is individuals and legal entities making payments to individuals or legal entities managing the hotel.

The taxpayers of the hotel tax are individuals and legal entities managing the hotel.

The following taxation objects for hotels and restaurants are exempt from payment:

Services provided by a hotel (restaurant) whose sales do not exceed the threshold established by local legislation. Accordingly, each district/city must establish the turnover amount for the restaurant business that is not subject to taxation.

Services provided by a restaurant or cafe with management combined with a hotel.

Other taxation objects established by local legal acts.

Hotel Tax Rate and Basis for Collection

The basis for collecting the hotel tax is the payment amount or the amount owed to the hotel.

Tax Rate for Hotels

The rate is set by local authorities but is typically 10%.

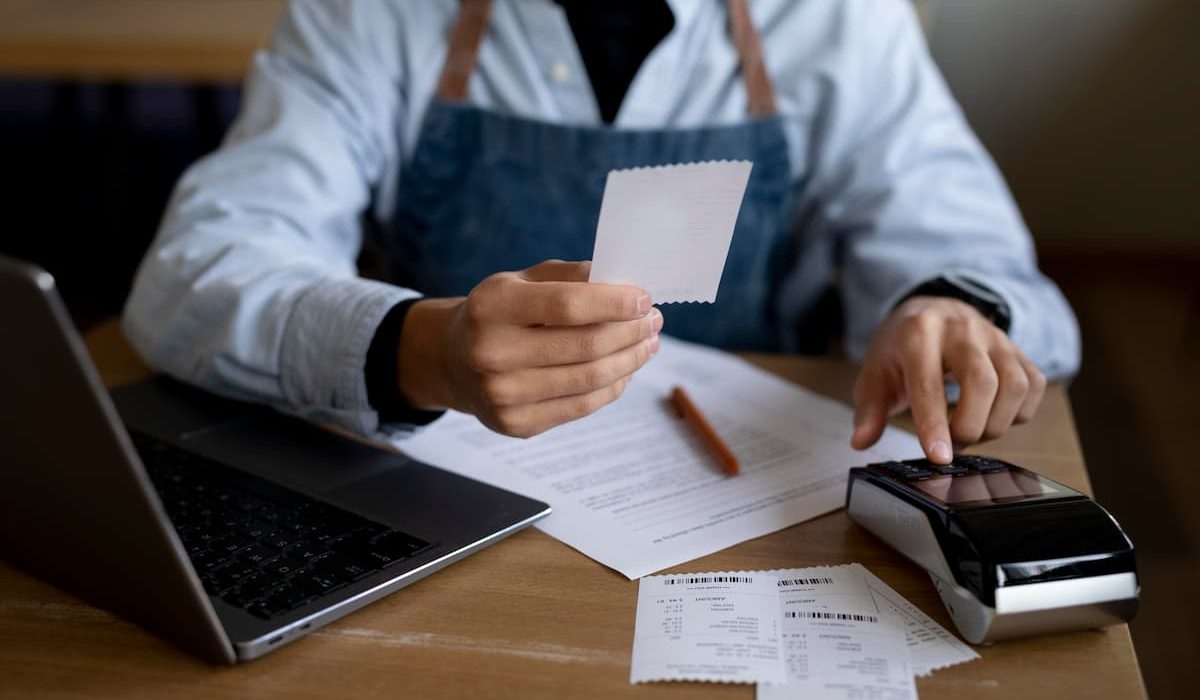

Calculation of the Hotel Tax

The tax amount is calculated by multiplying the tax rate by the tax base.

For example: PT “AAA” has a hotel turnover for April 2023 of 500,000,000 IDR (500 million). Then, the payable tax will be:

Tax base 500,000,000 * 10% tax rate = 50,000,000 IDR

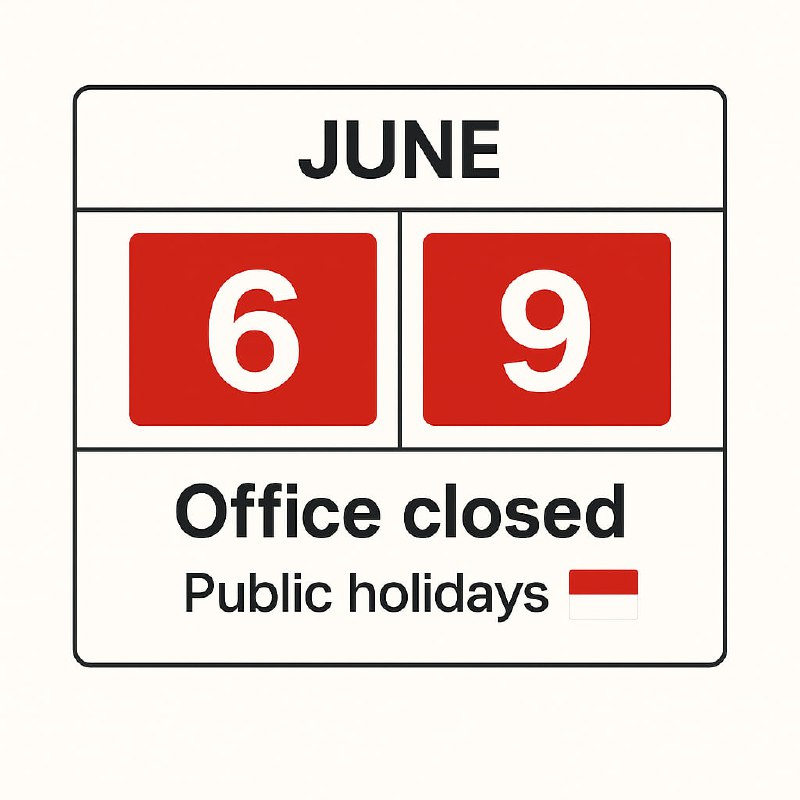

Conditions for Paying Restaurant and Hotel Tax

The business owner is responsible for calculating the tax amount and making the payment. Taxes are collected in the district where the business is located. Calculation, payment, and reporting are done within one calendar month.

Taxation Period:

Duration: one calendar month;

Any part of the month is considered a full calendar month.

Payment Moment:

Tax is paid when services are paid for;

If payment is made before the services are provided, tax is due at the time of payment.

Local authorities may establish their own rules for collection, reporting, payment, and providing exemptions.

How to Pay Restaurant and Hotel Tax

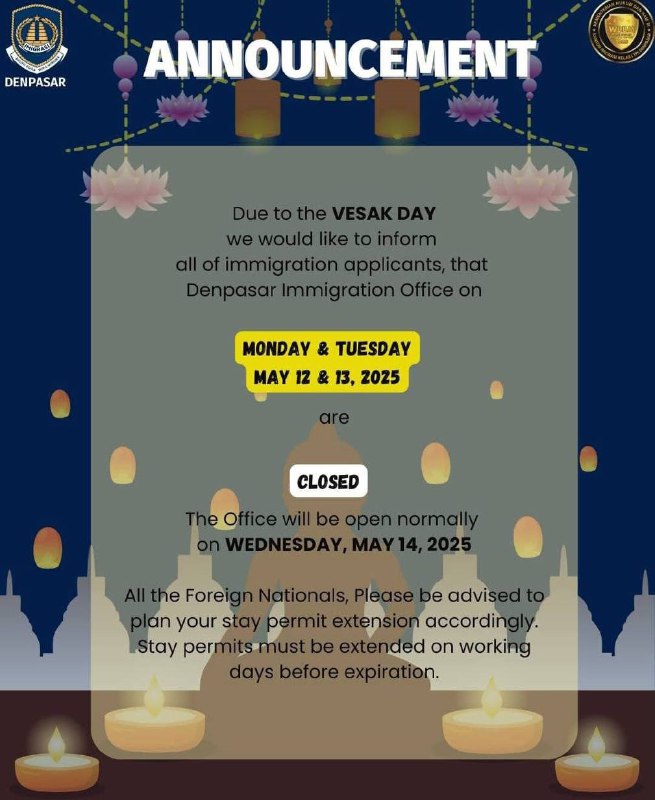

Payment must be made monthly, no later than 30 days after the end of the tax period. Late payment may incur an administrative penalty of 2% per month for up to 24 months.

Payment can be made directly by visiting the Revenue Department office of the region (Bapenda) or the Revenue Department of the city/district/province where your business is located.

Here is the payment process:

Visit Bapenda/Revenue Department;

Prepare necessary documents, such as Local Tax Payment Form (SSPD), fill out provided Bapenda forms;

Obtain the Local Taxpayer Identification Number (NPWPD);

Go to the cash desk.

Declaration of Restaurant and Hotel Taxes

Taxpayers need to submit a Local Tax Notification (SPTPD) to local authorities.