SP2DK: what it is and when it is issued by the tax authorities

SP2DK is an official request from the tax authority in Indonesia. In the letter, the inspector asks a company or individual to explain discrepancies in reporting or suspicious data. It is not a fine and not an audit, but an important signal that there are questions about your documents.

When SP2DK is usually issued

The request appears if the tax authorities see:

discrepancies between bank account receipts and declared revenue;

differences between imports/purchases and submitted declarations;

zero or unexpectedly low reports with actual activity;

discrepancies between banking data (Automatic Exchange of Information) and tax reporting;

inconsistencies between BPJS, OSS, LKPM reports and tax declarations;

long absence of reporting by the company.

It's important to understand that SP2DK is not yet a fine, not an audit, and not an automatic tax reassessment. SP2DK is an invitation to provide explanations and resolve the issue without an audit.

A competent response usually concludes the matter. Ignoring or providing incorrect explanations almost always leads to a tax audit.

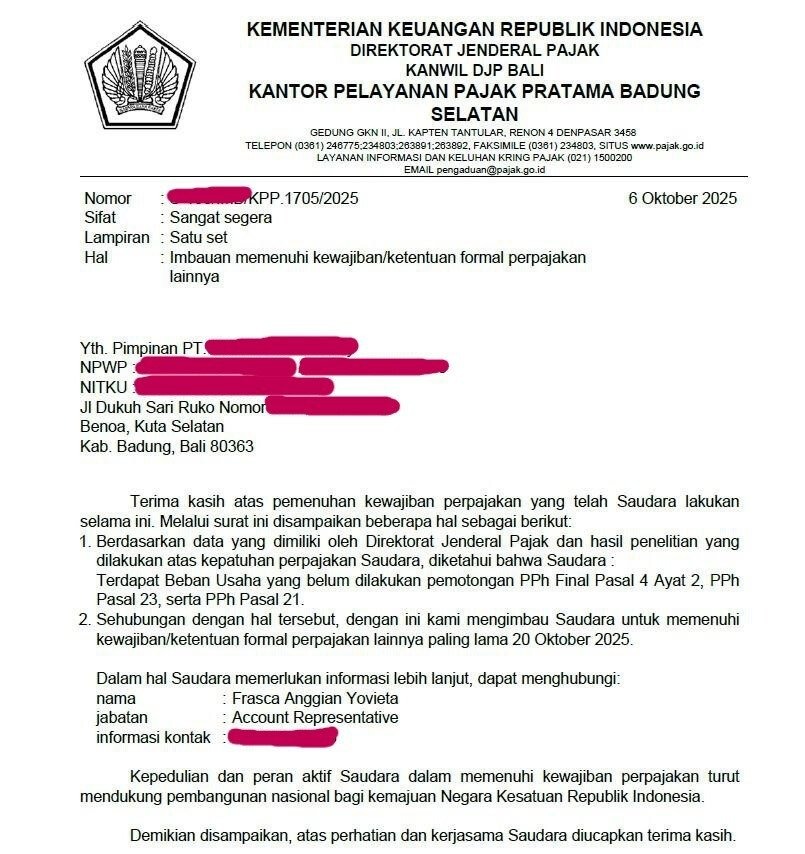

Sample letter

What SP2DK support services include

We assist in going through the procedure correctly and calmly:

analyze the request and the data it refers to;

develop a position (both financial and legal);

prepare a response letter—Surat Tanggapan SP2DK;

revise reporting if necessary;

communicate with the tax office KPP;

accompany meeting with the inspector;

ensure the case is closed.

What additional expenses might be possible

They depend on the situation and may include:

revisions of reports for past periods;

payment for the missing amount of tax on the unaccounted part of revenue;

penalties and interest in case of arrears;

restoration of accounting for periods without reports or with errors.

The prices for support are indicated without considering these expenses.

Cost of SP2DK support

The price depends on the company's turnover and amount of operations:

Zero company—5 million rupiahs

Small company—7 million rupiahs

Medium company—12 million rupiahs

Large company—from 16 million rupiahs

What will need to be provided

For work on SP2DK, the following are required:

monthly and annual reports;

bank statements, checks, contracts, invoices, and other data on transactions for the requested period;

access to DJP/Coretax (login and password);

founding documents: Articles of Association, AHU data, SK, NIB, KITAS if available, and a copy of the director’s passport, company's NPWP.

SP2DK is an opportunity to explain the situation before an audit begins. A timely and clear response reduces risks and saves money.

If you have received an SP2DK and are not sure how to respond, support in such a situation greatly simplifies the process and helps avoid an audit.